Sandy Trails — Building Blocks

Budgeting isn’t easy. Let’s face it, for most people, budgeting isn’t even interesting. But it is worth it. Not knowing where your money is going is unorganized at best, and at worst ensures you’ll stay in debt and far away from your financial goals.

If you’ve struggled to pull it off in the past, it’s possible you just haven’t found an approach that fits your personality and financial situation. Budgeting isn’t a one-size-fits-all thing. You’ve got plenty of different methods to choose from, and you can even mix and match, borrowing the best pieces from different strategies to create a budgeting style all your own. Ready? Let’s do this.

Know where you stand

To win at budgeting, you first need to know where your money goes. Track your spending for at least one month to get a realistic picture of your finances.

At a minimum, you need to know how much you earn after taxes and how much you spend on basics like housing, food, transportation, healthcare, and entertainment every month. Create categories to keep track of everything you buy. Occasional costs like vehicle registration fees or your dog’s vet visits should be budgeted for, too. Going more detailed with your categories (and tracking) can give you an even better snapshot of your spending habits—up to a point.

There’s a delicate balance between knowing absolutely nothing about your spending and knowing too much. Getting too granular will make budgeting more of a chore, which in turn, makes it less likely to happen. At some point, it’s best to just group things together. For example, if you subscribe to multiple streaming services, those can be simply grouped under “Entertainment” or “Subscriptions.” Food expenses can be broken down into “Groceries” and “Eating Out,” don’t worry about tracking things like takeout versus drive-thru unless it’s going to help clarify some spending patterns for you. Create a “Miscellaneous” category to track small purchases that don’t fit into your everyday spending.

Choose your budgeting philosophy

Once you understand your current spending habits, make a plan. There are plenty of budgeting methods to choose from, but we’ve detailed some tried-and-true approaches below.

Zero-based budgeting

The idea behind zero-based budgeting is to have a plan for every penny of income you earn, eliminating the problem of never knowing where your money goes.

To get started, add up all your income—this is what you have to work with each month. Then list all your typical expenses, including irregular expenses (you can create a “buffer” category to handle those, just divide the cost of the expense by the months you have to set aside funds for it). Finally, create additional “expenses” that will improve your finances, like retirement savings, debt repayment, or an emergency fund.

Once you’ve got your expense categories set up, assign portions of your income to cover those categories. The trick to pulling off this budgeting method is to have a plan for every dollar you earn. If you have money left over, you give it something to do—even if that’s dedicating it to a “fun money” category or saving a little extra. That way, you never overspend in any one category (say buying clothes) because you know what your limit is.

There’s an app for that: You Need a Budget is designed for zero-based budgeting. YNAB is more of a service than just an app, with video lessons, podcasts, and a support team to help with questions. YNAB costs $5 per month after a free trial.

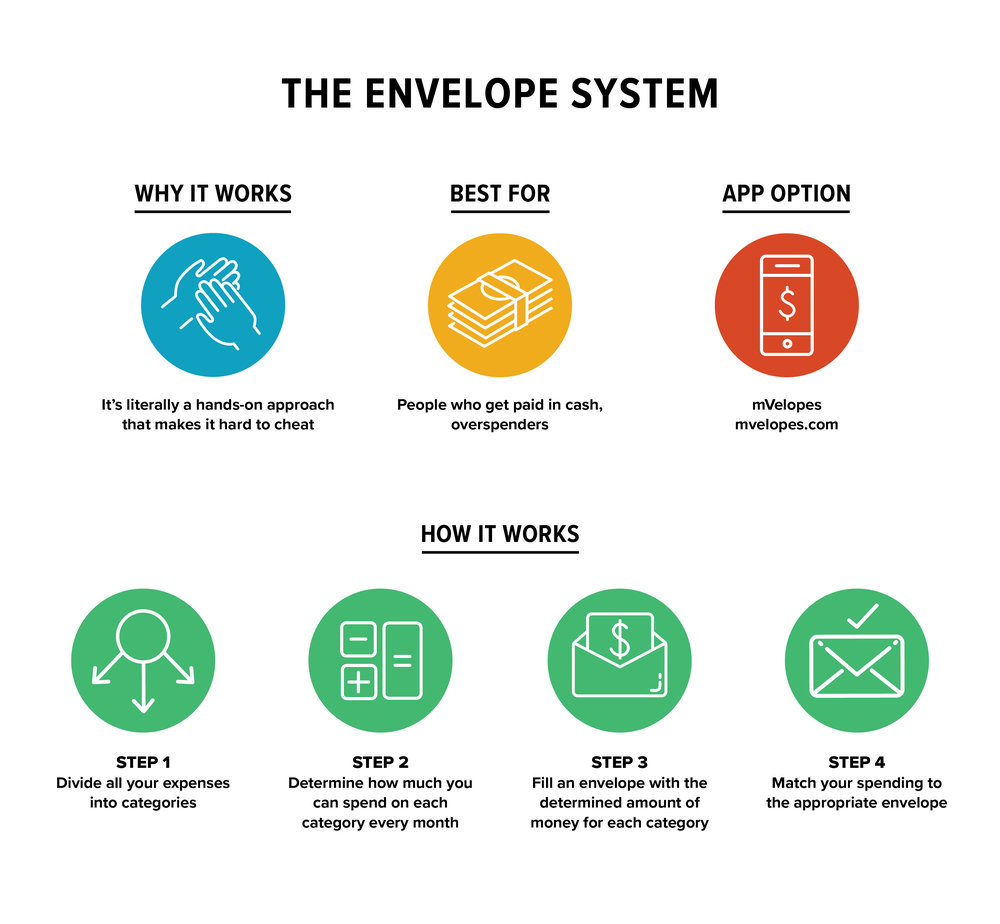

The envelope system

The envelope method is one of the simplest budgeting methods. It is literally a hands-on approach that makes it hard to cheat.

The old-school approach uses actual envelopes and cash, and that still may work best for folks who take home a lot of their income in cash. After you’ve determined income and expenses, figure out how much you can afford to spend on each category every month—say $400 on groceries. Then get an envelope, write “Groceries” on it, and put $400 of cash inside.

For this strategy to work, you must be diligent about matching your spending to the appropriate envelope, and you’ve got to stay disciplined. You will watch your income disappear as you use up cash, and if one of your envelopes runs dry, be prepared to make difficult choices and sacrifices.

If you end up spending less than you budgeted for, you’ve got options. The smartest idea is to put that extra money towards your long-term financial goals (pay down some debt or put it into your retirement account). Alternatively, you can treat the money like rollover minutes on your cell phone and spend a little extra in whichever category has the surplus next month. Or, you can take the money saved in one category and reallocate it to another, lighter envelope.

Envelopes are especially handy for in-person spending, where you’re particularly susceptible to impulse purchases and overspending on items. But the obvious drawback of the traditional method is that household bills and debts are rarely paid in cash. If you want to go truly old-school, you’ll need to get a large sum of cash every month and either pay large bills in cash or buy money orders (which come with fees). Thankfully, the envelope system has a digital counterpart [see below].

There’s an app for that: mVelopes [https://www.mvelopes.com/] tracks your spending in certain categories as if you were drawing down cash in an envelope. Similar to the envelope system, you see a decreasing account balance (the amount of money available for a given category) so you know where you stand at a glance.

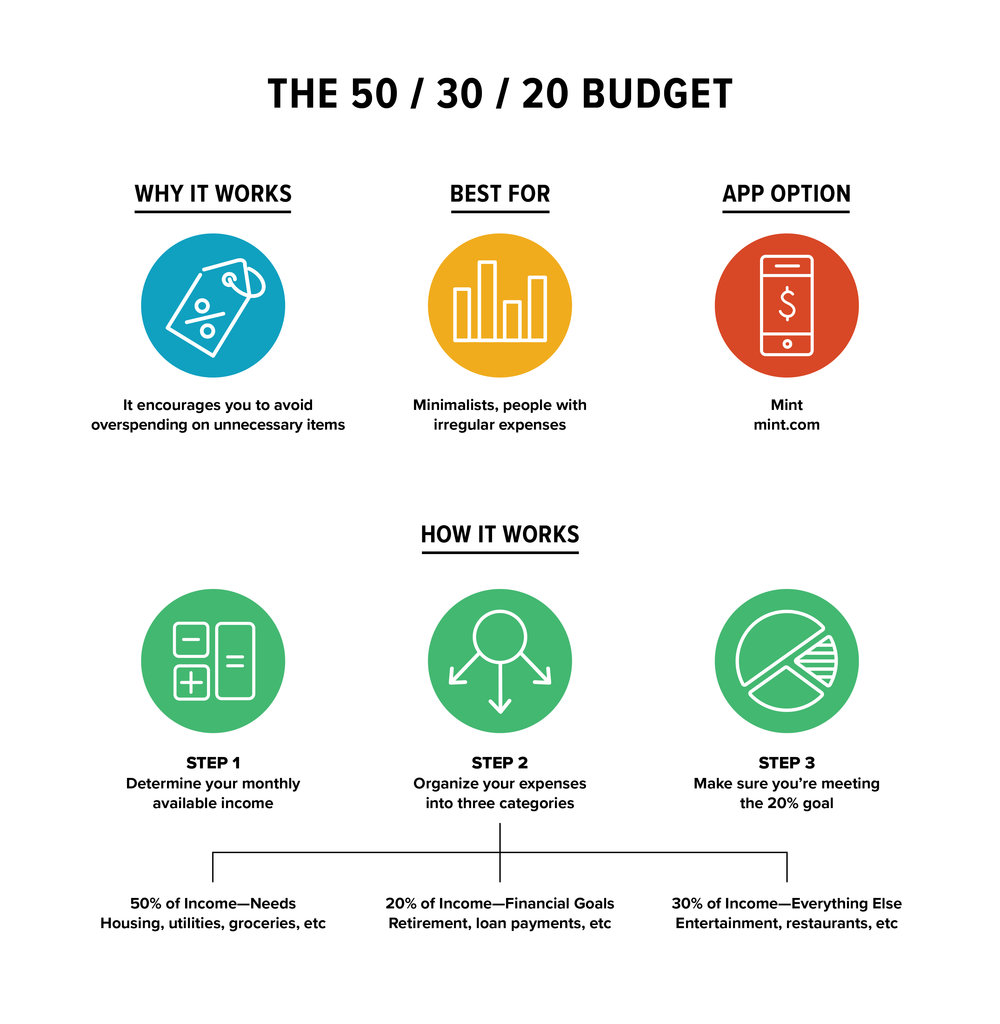

The 50/30/20 budget

If you’re not into micromanaging your money, and you have pretty good financial hygiene to boot, the 50/30/20 budget might be the best fit for you. It gives you guidance on how much you should spend every month, but it doesn’t require tracking individual categories as much as other methods. The idea is to use your income prudently and avoid overspending on unnecessary items.

To use this system, figure out your monthly income (remember: after taxes) and divide your expenses into three broad categories:

-

Needs: Housing, basic food expenses, utilities, and transportation should take up no more than 50 percent of your monthly income.

-

Financial goals: Saving for your future or aggressive debt repayment takes up the next 20 percent of your income.

-

Everything else: Vacations, spontaneous purchases, entertainment, your dog’s manicurist, whatever, can collectively amount to no more than 30 percent of your income.

While the 50/30/20 rule provides flexibility, it might be a little too flexible. The distinction between a need and a want can be fuzzy, and temptation can lead you to gloss over important financial decisions simply because both options fit into your percentages. For example, you need transportation, but the method doesn’t really help you decide between making a car payment on a sensible used car or a new, expensive sports car. As long as those payments fit into the broad acceptable amount, you’re good.

And like any system that tells you what you “should” do, take these numbers with a grain of salt. If you’re spending more than you should in any category, that’s a red flag worth investigating, but it doesn’t necessarily mean you’re doing something wrong. Depending on your circumstances (expenses related to living in a high-cost area or health issues, for example), everything might not fit tidily into the right category. Perhaps the most important thing is the 20 percent goal—that’s the one that will buy you a better future.

Make it work for you

Any budgeting method requires some amount of effort. Knowing what you’re realistically willing and able to do can mean the difference between sticking with it or burning out.

As you evaluate the methods above (and other budgeting systems), think about how they fit your lifestyle:

-

The time commitment: Will you do a little bit daily (matching your spending to certain categories, for example), or does it need to be done in one large chunk each month?

-

The rules: Do you want broad guidelines (such as the 50/30/20 rules) or would you be better off with specific spending categories?

-

The delivery vehicle: Do you prefer pen and paper, or are you a fan of apps with charts and graphs?

-

The day-to-day: Do you need to be reminded of your budget before you spend, or can you tally everything up later in the month?

Keep it simple

Budgeting works best if you don’t have to focus on it day in and day out. When you get started, it’s tempting to create a line item for every possible spending category, but doing so will make budgeting more time-consuming, and you’ll likely end up frustrated. Instead, focus on the most important expenses and budget-busters in your life. Start with broad categories, and drill down into more detailed categories once you become more aware of your spending habits.

When choosing a budget style, avoid methods and apps that require a lot of manual tracking, unless you’re such a compulsive spender that such effort doubles as a financial detox aide. Likewise, if you opt for an app make sure it’s not overwhelming you with reminders and notifications, which can also contribute to budget burnout.

While budgeting will likely never be fun, with a little set-up time and practice, it can be simple.